Happy Monday with Dean and Crystal…

Hey there Market-Watchers,

Happy Monday-goers and Santa’s helpers…2021 has flown by, but it also feels like it’s lasted 10 years…right? What a roller-coaster of a year!

BTW: This is our last weekly housing report of the year and Crystal, and I will be back in your inboxes with fresh Tid-Bits and market-worthy statistics on January 3.

Tid-Bits (or…hors-de-oeuvres…because it’s that time of year):

- The stimulus effect…Since the third stimmy landed in March (another $1.9T), the US economy has rebounded hard. Spending boomed thanks to extra $$$ for consumers, stocks rallied to new highs, and unemployment has fallen to near pre-pandemic levels. But as the economy revved up, supply issues abounded (#EverythingShortage) and prices soared. 2021 was all about stimulating spending; 2022 could be about cooling. The Fed plans to hike interest rates three times in the new year to tamp down inflation, which hit a 39-year high last month. Meanwhile, JP Morgan Chase believes ’22 will bring a full global recovery.

The Takeaway: The easy-money party is over… and rate hikes may be the cure for an overspending hangover.

- Real Estate: Home prices soared to fresh records in 2021, spurring the most home sales in 15 years…and for the last 2+ months, we’ve been reporting fewer homes available for sale…and still falling…strong buyer demand, multiple offers and offers with few contingencies.

It’s the solstice and let’s see what we can take from last week’s market activity…

Today, December 20, the median single-family home price is $374,900…basically unchanged from last week. the price of the new listings was $340,000…$9,000 down from last week. It is this indicator here that we’re watching in January as this will give us a big clue as to how the market is going to perform in Q1-Q2 of 2022.

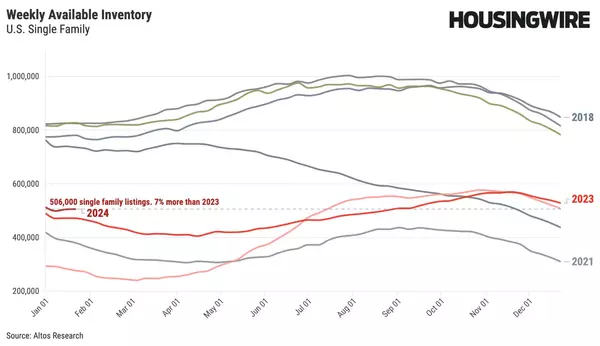

Even if demand should suddenly weaken…we’re still going to start the year with record lows in the number of existing single-family homes for sale…With 2 weeks left in the year, there are currently 326,000 homes for sale, and we wouldn’t be surprised if we ended the year with under 300,000 homes in the inventory. The low point for available homes for sale was April 30, 2021, with 307,000 units available for sale…and we remember how insanely competitive the market was at that time…?

Could inflation lead to lower inventory in 2022? That is a really tricky question and consider this…as the cost of keeping existing homes, due to the low-interest rates of the last several years, continues to remain inexpensive…does that cause homeowners to continue to hang on to their homes…even as they purchase new ones…causing inventories to continue to shrink, even in the face of rising interest rates? Just something to keep our eyes on next year.

Last week, out of the 58,000+ new homes that came on the market, a healthy 18,243 (31%) qualified as immediate sales and are already in contract heading into this week.

There are over 425,000 homes currently in the ‘Contract Pending’ status right now. In the New Year, we should be able to watch that number to see whether the market will be cooling or staying very robust and competitive in January.

So much to watch and analyze for the New Year. Crystal and I will continue to try to provide our view of the market through the lens that we see real estate activity through and allow you to use our information to make decisions based on a view that looks forward as opposed to looking in the rear-view mirror.

Are you ready to look at our LOCAL markets?

- Castro Valley: This week the median list price is $1,293,944 which is up a bit from last week with the Market Action Index (MAI) at 92. Median Days on Market is at 25 this week, up from last week’s 11. The inventory is up to 14 from last week’s 11. Home sales continue to outpace supply and the Market Action Index (MAI) has been moving upward for several weeks. This is such a strong seller’s market so watch for continued upward pricing pressure in the near future if the trend continues.

- San Lorenzo: This week the median list price is $850,000 with the MAI up to 93. The list price is almost unchanged while inventory is relatively unchanged at 5 and Median DOM is still at 7. Home sales continue to outstrip supply and the Market Action Index has been moving higher for several weeks. This is a Seller’s market so watch for upward pricing pressure in the near future if the trend continues.

- San Leandro: This week the median list price is up to $850,000 with MAI at 92. Inventory is at 18 and median DOM is at 14, double from last week’s 7. Home sales continue to outstrip supply and the Market Action Index has been moving higher for several weeks. This is a Seller’s market so watch for upward pricing pressure if the trend continues.

- Hayward: this week the median list price is $899,000, up from last week’s $850,000. The MAI is down to 84 this week, and inventory has increased to 43, and Median DOM remains at 21. The market remains in a relative stasis in terms of sales to inventory. Prices have not been moving higher for several weeks. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up persistently, prices are likely to resume an upward climb.

- Danville: this week the median list price is $2,750,000, with the MAI is 87. Inventory is at 17 and DOM is at 21. The market appears to have begun to cool. As we’re still notably in the Seller’s zone, prices have not yet adjusted. If the market continues to cool, then expect prices to follow lower. It may take a few more weeks of slack demand for prices to reflect and begin to fall. Expect this condition if the index falls to the Buyer’s zone.

As we wind down today’s report, I find it interesting that our local markets are both very individual when we look at them side by side. If we lump them together, they also perform the same as the overall US Market performs…just at different price levels. I’m also wildly curious about what we’ll see in the New Year and how we as agents, consumers, and industry adapt to the ever-changing ebbs and flows of the market economy.

This is precisely why I do not have an interest in retiring or scaling back my activities as a realtor. I’ve always loved the challenges that come with every transaction, the different wants and needs of you, our clients, and keeping our skills honed and practiced so we remain at the very top of our profession in order to deliver the best service, customized for you in your and/or your family’s next venture into the real estate market.

Merry Christmas, Happy Holidays from myself, Crystal, and the Team…wishing you joy, happiness, and opportunities in the New Year.

Warmly, Dean Souza

Dean & Crystal Souza

Realtor | Broker Associate

Century 21 RE Alliance – Souza Team

homes@souzateam.com

510-881-1761

DRE 00967442 | 01448392

Focused on the Success of Your Move

This is not intended to solicit properties or persons under contract.