Happy Monday with Dean and Crystal…

Well, hello there, again…and yes…it’s Monday again…just another Manic Monday……

Tid Bits:

- What was the scariest Halloween costume of 2021?… (Drum roll please) A spam caller selling auto warranties…badda boom!

- Fly like a G20… or Air Force One over the Colosseum…over the weekend, leaders of the world’s biggest economies met IRL for the first time in two years and endorsed a minimum global tax rate of 15% for multinational corporations, aiming to implement it in 2023…. after shelling out millions for a trip: SpaceX’s first tourist flight featured some unexpected liquids after a toilet tube broke loose under the cabin floor.

- The Market: this week and how is it different from November 2020?????

The market remains strong…and it’s a very different market from last year while we were in the middle of the pandemic.

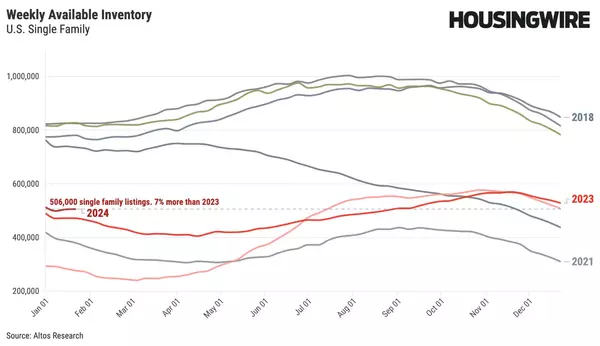

-Inventory: In the US, there are slightly more than 413,000 homes on the market, or a 2% decline from last week. This decrease is not to be unexpected for this time of year as some seasonal normalcy has returned to the national real estate market. Assuming that there isn’t a large influx of inventory from the forbearance exit, this projects to end the year at around 300,000 homes available for sale. This will be about 1/3 less inventory than we began 2021 with.

Speaking of the forbearance exit…it appears that many of the homeowners in that program are either extending or re-working their loans and can do that because of the equity buildup (22%) over the last two years.

It’s been interesting as we track the immediate sales (0-10 days) …and amid decreasing inventory, the percentage of immediate sales remains constant at about 25% of the newly listed properties selling within that ‘window’. This indicator leads us to believe that there is still an ample supply of well-financed buyers, and that trend is likely to continue well into next year.

- Mortgage Rates:The caveat for demand is whether and how quickly mortgage rates climb. The 30-year fixed-rate mortgage is currently at 3.14% and is almost back to the highest rate it’s been all year. It will be interesting to see how buyers adjust their affordability calculations next year assuming that interest rates continue to climb.

-Price:

The median price of a single-family home dropped 1%, down to $386,000. That is the biggest one-week decline since mid-August. It IS November and that is to be expected at this time of year (think Normal Market)

The price of newly listed properties also dropped this week and likely continue to drop through the 2nd week of January. These indicators are forecasting that we’ll likely end the year with somewhere between 10%-12% increase in price, year over year.

Last week, the Case-Schiller index released its August report, forecasting 19% gains…and… remember, Case-Schiller is reporting on data from way back in June, July, and August or 6 months ago… we are actually looking into the end of the year and into January.

One of the indicators we are watching for any signs of market cooling is the number of homes that are re-listed, which is slightly elevated. These are homes that for whatever reason, didn’t sell; maybe the transaction fell through, they were priced too high, or for some other reason. In a declining market, these numbers shoot up and also shoot up in January because of homes that were taken off the market for the holidays. Re-lists are currently at 1.6% of the inventory. This indicator tells us that price increases for 2022 will be more moderate than the last two years and the buyers are more price-sensitive.

- Days on Market:

DOM ticked up to 42 days, up from 22 days earlier in the year. Normally, at this time of year, DOM is at 70 days. Last year, in November 2020, demand was actually escalating, and that trend foretold how strong Q1 in 2021 was going to be. This year, we are looking at DOM climbing until the Spring Market starts to kick in sometime in February.

If there’s a theme or trend, then it is that we are in a more normal market than we have seen in the last 24 months. I’ll be back next week and I’m interested to see how this plays out through the end of the year.

We have the ability to send you weekly, mlonthly or quarterly reports on your real estate investment’s value and where it’s trending. If you would like to receive this type of information and at any interval that you chose, reach out to either one of us and we’ll set that up for you.

TTYL.

Warmly, Dean & Crystal

Dean & Crystal Souza

Realtor | Broker Associate

Century 21 RE Alliance – Souza Team

homes@souzateam.com

510-881-1761

DRE 00967442 | 01448392

Focused on the Success of Your Move

This is not intended to solicit properties or persons under contract.