Happy Monday with Dean and Crystal…

Hey there…I know it’s Wednesday and Crystal & I were able to see Andrea Bocelli on Saturday night in Sacramento. The rain was so bad we decided not to try and drive home until Monday when the storm subsided…am I a Day Late and a Dollar Short?…

Tid-Bits:

- Hertz so good Car-rental giant Hertz is buying 100K Teslas for an estimated $4.2B, the biggest EV purchase ever. They will be available for rent next month.

- LunarPark: Jeff Bezos’ Blue Origin plans to create a commercial space station with Boeing. They aim to launch the galactic “business park” before 2030.

So… while we were bracing for our first rainstorms of the year and an early end to fire season, what did the real estate market do last week? well…I’m glad you asked!

The very last of the year’s real estate season is wrapping up and what we’re able to see is how the year is going to end and how 2022 is starting to shape up. We’re also watching if there is any impact from rising interest rates and the end of forbearance.

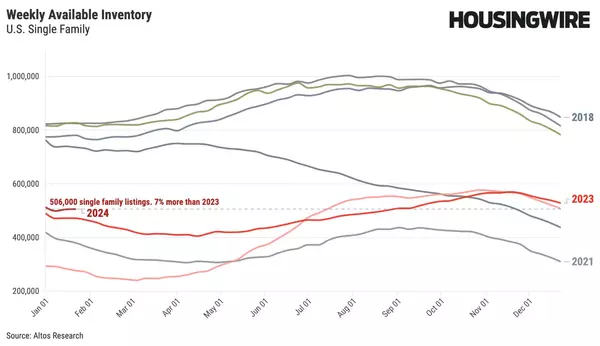

As of yesterday, there are currently 422,770 homes for sale in the US. Inventory is still dropping, as it does historically in October and through the end of the year. We’re currently about 3.3% below the peak inventory back in September.

Over the last decade, Americans have aggressively been buying more properties for rental and investment, and each year we’ve had fewer and fewer homes available to buy which have resulted in decreasing inventories each year.

When will the inventory shortage end? As of right now, it looks like we’re going to end the year with new record low number of homes for sale…somewhere a bit over 300,000 homes for sale. This projects out to the spring when we’ll likely have fewer than 300,000 homes available for sale.

Now…mortgage rates are rising, and they are back above 3% for a 30-year fixed-rate mortgage. At some point, it will begin to feel ‘expensive’ to purchase a home. That, in turn, will cause the market to slow down.

I am also still looking at the number of homes that will exit forbearance for any indication that we’ll see an influx of new homes going on the market. I’ve also been reading about foreclosures having an impact on the inventory.

If there are any unseasonal spikes in inventory in November, then we’ll see it in the indicators that I look at each week. I’m of the opinion that I am not counting on this to happen…so, we’ll see.

Pricing ticked down a bit last week, which is normal for the third week in October to $389,000. This price is still at an 11+% annual gain in home pricing over last year…that’s pretty healthy if you ask me.

Today, you’ll start to see headlines and articles screaming about ‘record appreciation. We’ll see this because the Case-Schiller index will report today and remember, Case-Schiller is reporting on market data from back in July and August. The data that I am looking at is what’s happening today, this week, and what is likely going to happen in the not-too-distant future.

So, you can draw your own conclusions about the data. Many of our clients who have opted to take advantage of the historical decrease in inventory in the fourth quarter and early first quarter, put their homes on the market and have performed better than you might think.

Depending on the individual situation, we can ready a home for market in as little as 48-72 hours. If there are projects that you’ve been putting off, whether it’s a new fence, painting, repairing deferred maintenance…we can make those upgrades quickly and with no out-of-pocket up-front expense to you.

If you have a property that is in probate, trust, or property that is in any stage of disrepair, we also have our ‘as-is’ and ‘all cash’ programs.

For an analysis of what works best for you, call, text, email, or message via social media and we’ll make it a priority to guide you on the path that matches your goals.

Warmly, Dean & Crystal

Dean & Crystal Souza

Realtor | Broker Associate

Century 21 RE Alliance – Souza Team

homes@souzateam.com

510-881-1761

DRE 00967442 | 01448392

Focused on the Success of Your Move

This is not intended to solicit properties or persons under contract.