Happy Monday with Dean and Crystal...

Hey there, Tribe…’ it’s just another manic Monday…oh, oh, oh (Belinda Carlisle)… and… here’s what’s new this week…

– Pill: Pharma giant Merck filed for FDA approval of its Covid pill. If approved, the first swallowable antiviral Covid drug could help cut hospitalization and death rates.

– Brew: Starbucks turned 50 last week. I was reading about Starbs’ transformation from a small bean seller to a $131B giant that accounts for nearly half of US coffeehouses.

– New research shows flier satisfaction jumps 5% when overhead bins are bigger. Imagine the percentage jump if you didn’t have to sleep face down on your tray table.

Here is what the market data is telling us TODAY about the health of the US Housing Market:

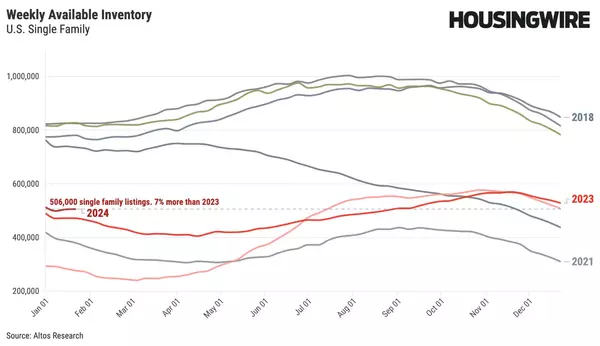

Housing inventory declined…again, by about .5% last week, which is normal for this time in October. Even with the number of mortgages exiting the Forbearance process (10% of all mortgages each week) …we’re still not seeing any appreciable increase in new listings because of this.

This is 3% down from the September peak and 23% lower than last year at this time.

So… that is the Supply-side…What about the Demand-side?

Mortgage rates are now back up over 3% (the highest point since April), and still exceptionally low by any measure. Twenty-three percent of all newly listed homes are still selling within the first week and the pricing of that segment of the inventory increased 11%. This indicator shows that we are still in a strong seller’s market.

There is one little potential sign of a weakening market that we’re watching… and it’s something we call ‘Re-Lists’. These are properties that had previously been listed and are now coming back on the market. This segment is only at 1.7% of the total inventory and it does seem to be inching up. We’ll continue to watch this as we head into Thanksgiving.

I’ve been asked more than a few times, why I write about the National Market versus writing more local or hyper-local, which is a very reasonable question. I’ve often considered that myself and have concluded that I prefer to look at the overall ‘big-picture health’ of the US housing economy, as an indicator of where we’re headed. I prefer that view because being too hyper-local, by the time things change, it results in a late start and a reaction instead of a proactive decision-making process.

In 2006, this larger view allowed Crystal and me to see problems brewing before the actual economic meltdown occurred. We were able to advise our customers and clients of such and adjust our marketing and business models and resulted in increased business and sales while the rest of the industry was spiraling in the opposite direction.

If you would like a hyper-local report on any of your real estate investments, we have that information available at your request. We can drill that down to the city, zip code, or carrier route. Engage with us via text, phone, email, social media, What’s App, Tik Tok…

Here’s to getting all the Halloween decorations out this year and here’s a tip: keep your hands out of the candy dish. ?

TTYL.

Warmly,

Dean