Happy Monday with Dean and Crystal…

Monday Market Matters

With The Souza Team Century 21 Real Estate Alliance

Weekly Digestible Real Estate Market Updates

It is… another Monday, and it is that day of the week where we look at the behavior of the housing market, leading indicators of market trends, both in the U.S. …and locally.

How was your weekend? Shall we get started with some appetizers and some ‘Tidbit’s?…

– The drones are coming… with your allergy meds. Retailers from Amazon to Walmart are finally starting to deploy delivery drones after years of hype.

– Fanny packs and flower crowns… #FestivalSzn is back. Coachella, Cali’s most Insta-worthy music festival, returns for the first time in two years this weekend.

– Wall Street’s iconic Charging Bull statue now has a crypto cousin: Miami’s bitcoin-happy mayor unveiled a 3K-pound robo-bull as a symbol of the city’s crypto bullishness. Of course it has laser eyes.

– SNACK FACT of the DAY: White-collar workers are spending 250% more time in meetings than they were pre-pandemic

Ready… for the main course?

– Let’s look at the US Real Estate Market and how it performed last week:

Demand for Homes Still strong as Mortgage Rates Climb…Is the Market Cooling Off? Are there indicators pointing towards a slowdown?

This week we appear to be at an interesting intersection in the market…

On one hand, interest rates have spiked to their highest point in years…Prices and Demand must react to that, right?

On the other hand, there is so much momentum and cash to deploy…that we’re simultaneously hitting new record home prices each week…

Home prices are climbing and jumped to $415,000 last week…up, another 1% from last week and 10% from last year.

We are hearing of buyers…on the sidelines, with $cash$…that are waiting, hoping to avoid the bidding wars, and ready to pounce on new inventory as it appears as a new listing. If this plays out, it could temper any downturn that we might have because of the rising interest rates.

Last week, the New Listings came in at $410,000 and staying pretty elevated. If there is a slowdown, the price of the New Listings is where it will show up first.

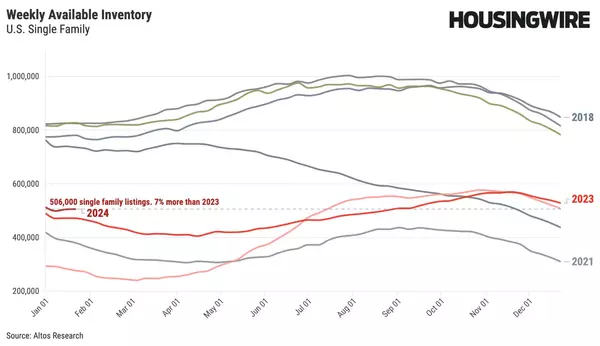

Inventory continued to rise last week and at the end of the week, there were 261,173 unsold single-family homes available for sale, a 2.3% increase from last week and 5% above the lowest point ever of 1 month ago.

Because you’ve been following theImmediate Sales with me, you understand that when things do slowdown and inventory rises, we’ll see the number of homes that sell within hours or days decline. This week, 26,000 homes fell into this category…that’s 29% of the new inventory, and still a lot…however, it’s the lowest per centage of new listings since January.

We also observed a slight rise in the number of Price Reductions last week. There were 17.5% of the homes on the market that took a price adjustment last week and are trending upward. In a normal market, we would expect to see this indicator 25%-30% range.

And again…we will report back next week…so, now Let’s Get Local…and track the markets where a lot of live…

Castro Valley: This week the median list price for Castro Valley, CA is $1,499,999 with the market action index hovering around 84. This is less than last month’s market action index of 86. Inventory has increased to 27. Median Days on Market is at 7 this week while the average is at 31 days. Market conditions have been consistently cooling in the past several weeks. Because we’re still in the Seller’s zone, prices have not yet begun to drop. It may take a few more weeks of slack demand for prices to reflect and begin to fall. Expect prices to fall if the index persistently falls to the Buyer’s zone.

San Lorenzo: This week the median list price for San Lorenzo, CA is $838,000 with the market action index hovering around 93. This is less than last month’s market action index of 94. Inventory has increased to 11. Median days on market is at 0, while the average days on market is at 3. In the last few weeks, the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

San Leandro: This week the median list price for San Leandro, CA is $949,888 with the market action index hovering around 87. This is less than last month’s market action index of 90. Inventory has increased to 37. Median days on market is at zero while average days on market is at 3. The market has been cooling over time and prices plateaued for a while. Despite the consistent decrease in MAI, we’re in the Seller’s zone. Watch for changes in MAI. If the MAI resumes its climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

Hayward: This week the median list price for Hayward, CA is $899,497 with the market action index hovering around 94. This is an increase over last month’s market action index of 93. Inventory has increased to 50. Median days on market is 7 while average days on market is at 28. Home sales continue to outstrip supply and the Market Action Index has been moving higher for several weeks. This is a Seller’s market so watch for upward pricing pressure in the near future if the trend continues.

Union City: This week the median list price for Union City, CA is $1,588,888 with the market action index hovering around 84. This is about the same as last month’s market action index of 84. Inventory has increased to 13. Median days on market is at 7 while the average days on market is at 12. In the last few weeks the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

Danville: This week the median list price for Danville, CA is $3,250,000 with the market action index hovering around 88. This is an increase over last month’s market action index of 85. Inventory has increased to 29. Median days on market is at 7 this week and the average days on market is at 84. Home sales have been exceeding new inventory for several weeks. However prices have not yet stopped falling. Since the market is already in the Seller’s zone, expect prices to level off very soon. Should the sales trend continue expect that prices could climb from there.

In summary:

Pent up momentum and the liquidity of many of today’s home buyers are fueling the market even as interest rates continue to rise, and the expectation is that interest rates will continue to rise as the Fed grapples with runaway inflation, war, and volatile markets.

And while all these events are of concern from a moral and economic perspective, when we are in the home buying or home selling window, we must remain singularly focused on what is happening in the market right at that very moment.

As your Real Estate Market Experts, Crystal and I have a deep understanding of the market’s complexities, a lengthy list of qualified buyers, and access to off-market opportunities. If you or someone you know is looking to buy, sell, or invest, contact us today!

We enjoy your comments and continued readership and I’ll sign off again with…

Happy Trails and until next week, be safe and healthy.

Warmly , Dean Souza

Dean & Crystal Souza

Realtor | Broker Associate

Century 21 RE Alliance – Souza Team

homes@souzateam.com

510-881-1761

DRE 00967442 | 01448392

Focused on the Success of Your Move

This is not intended to solicit properties or persons under contract.