Happy Monday with Dean and Crystal…

Happy Monday

With The Souza Team Century 21 Real Estate Alliance

Weekly Digestible Real Estate Market Updates

It is another Monday, and it is that day of the week where we look at the behavior of the housing market, both in the U.S. and locally, as well as other leading indicators of market trends…

Shall we get started with some appetizers?

Notable Numbers…

- $65M: How much Ukraine has raised in crypto donations so far. It was one of many unconventional ways, along with no-show Airbnbs and Etsy donations, that people supported global efforts.

- She-cession: US unemployment is nearly back to pre-pandemic levels, but women’s jobs are returning more slowly than men’s, partly because of unequal childcare duties and high-burnout jobs.

This Week.

- The weekend: The Final Four March Madness basketball games are on Saturday. The Grammys are on Sunday.

Random…

- If you can’t beat em… Uber, the ride-hailing app that once vowed to disrupt cab commerce now thinks food-delivery services, public-transit partnerships, and traditional taxis will fuel its next growth phase.

Ready… for the main course?

- Let’s look at the US Real Estate Market and how it performed last week:

Home prices hit new record high despite mortgage rate jump…

We’re watching how abruptly and how quickly consumers will react to the sharp rise in interest rates, meanwhile home prices hit a new record high!

Let’s start with a look at Prices…

The median price of a single-family home in the US hit a new record high last week and came in at new record high of $400,000…just a tick up from last week. The buying season is kicking in full force, and there’s still a lot more season left…In normal years, prices peak at the end of June before retracting in summer and dipping in the holidays.

Our suspicion is that, despite rising interest rates, that prices will continue to rise and possibly reach $420,000-$440,000 by the end of June…we shall see.

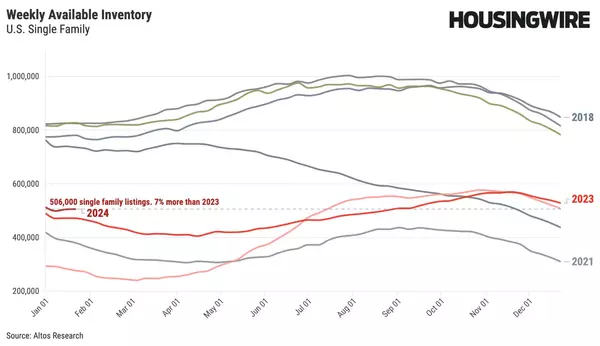

Inventory definitely turned a corner… and rose 2% last week to 253,000 homes available, unsold and listed for sale. This trend should continue, however, we don’t expect any new source of inventory to flood the market…in fact, it would take a couple of years of higher interest rates (5%+) to bring us to a point where we could get back to something resembling a normal number of homes in unsold inventory.

Demand…

Immediate sales are still very much a ‘hot’ category that we’re watching right now… one-third (34%) of the newly listed homes went under contract last week and within days or hours of being listed for sale, meaning that buyers have not backed off one bit…yet.

In summary, inventory continues to seasonally creep up and buyer demand has not slowed yet for any reason and as with any new trends, time will tell if interest rates are going to have any kind of dampening effect on inventory and prices.

Let’s drill down and take a look at our local markets and see how they performed in relationship to the national behaviors…

It’s exactly 2 years since the onset of the pandemic…(I know…don’t remind me)…

Interest rates are at the highest level since 2019 and buyer demand has not backed off, and the post-pandemic real estate market continues to surprise us.

Let’s start this week…again… with Inventory…

We ended the week with essentially the same amount of available, unsold inventory in the US as last week with 247,608 homes in that category…the slight decrease was actually due to some new home inventory being removed from the market due to extended completion dates.

To give some context to these numbers, in March of 2020, the lockdown had not hit yet and there were 740,000 homes in this category of available, unsold single-family homes…almost 3 times the amount of inventory we have currently.

As interest rates rise, we do expect to see some rise in the inventory with a projected year-end inventory of approximately 310,000 homes.

Pricing: The median home price has been inching closer to $400,000, a new record-high since the first of the year. This week we ended up $1 shy of that threshold and came in at $399,999.

Demand…or immediate sales remains at 31% of the newly listed inventory. Out of the 81,000 homes that were listed last week, 25,319 homes went into contract within hours or days. Historically, volume peaks at the end of June and with an expected rise of interest rates, and sellers facing more competition from increased inventory, sellers could be better of …selling now… rather than waiting to sell later in the year.

Days on Market…we are down to 28 days on market across the US…that’s ALL homes, all price points. There are very few homes that have sat on the market for a very long time, including those ‘wacky’ listings that tend to sit on the market forever…Last year in March, we had a 6-week inventory of homes available for sale. This year…28 days, meaning, if there were no homes listed for sale, we would run out of inventory in 28 days…

As we can see, the current trends continue to accelerate, week by week… and if history repeats itself, inventory peaks in June, then this is what we expect to see for the remainder of the year.

Okay, friends… it’s time to get local…

Here is what happened in our local markets last week:

Castro Valley: This week the median list price for Castro Valley, CA is $1,590,000 with the market action index hovering around 86. This is less than last month’s market action index of 89. Inventory has increased to 23 and median days on market are back to zero. Average days on market are at 30 days. Market conditions have been consistently cooling in the past several weeks. Because we’re still in the Seller’s zone, prices have not yet begun to drop. It may take a few more weeks of slack demand for prices to reflect and begin to fall. Expect prices to fall if the index persistently falls to the Buyer’s zone.

San Lorenzo: This week the median list price for San Lorenzo, CA is $799,888 with the market action index hovering around 94. This is about the same as last month’s market action index of 94. Inventory has increased to 7. Median days on market is again at zero while average days on market are at 5. In the last few weeks, the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

San Leandro: This week the median list price for San Leandro, CA is $879,990 with the market action index hovering around 90. This is an increase over last month’s market action index of 89. Inventory has increased to 19. Median days on market is again at zero and average days on market is at 7. The market has started cooling and prices have been flat for several weeks. Since we’re in the Seller’s zone, watch for changes in MAI. If the MAI resumes its climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

Hayward: This week the median list price for Hayward, CA is $929,000 with the market action index hovering around 94. This is an increase over last month’s market action index of 88. Inventory has increased to 41. Median days on market is 0 while average days on market is at 37. Home sales continue to outstrip supply and the Market Action Index has been moving higher for several weeks. This is a Seller’s market so watch for upward pricing pressure in the near future if the trend continues.

Danville: This week the median list price for Danville, CA is $2,598,000 with the market action index hovering around 85. This is an increase over last month’s market action index of 79. Inventory has increased to 37. Median days on market is 0 and average days on market is at 67. While the Market Action Index shows some strengthening in the last few weeks, prices have settled in a bit of a plateau. We are currently in a Seller’s market so prices will likely resume their climb should this trend persist.

In closing, I wanted to introduce you to a thought…that the real estate transaction is supposed to be about you…ALL about you.

It’s a simple thought and it’s also at the core of our Realtor Code of Ethics and the tenets of agency relationships with our customers and clients.

Crystal and I make it our priority to make it… about you, and when the client is #1…you simply …Work Harder.

Call us and experience the difference that we bring to each phone call, each transaction…and beyond. We look forward to hearing from you.

Happy Trails and until next week, be safe and healthy.

Warmly , Dean Souza

Dean & Crystal Souza

Realtor | Broker Associate

Century 21 RE Alliance – Souza Team

homes@souzateam.com

510-881-1761

DRE 00967442 | 01448392

Focused on the Success of Your Move

This is not intended to solicit properties or persons under contract.