Happy Monday with Dean and Crystal…

Hey there, Market Watchers…

It is another Monday, and it is that day of the week where we look at the behavior of the housing

market, both in the U.S. and locally, as well as other leading indicators of market trends…

Shall we get started with a TidBit or two?…

- Sun: Hold your clocks: The Senate unanimously passed a bill to make daylight-

saving time permanent. While the vast majority of Americans want a single time

system, there’s still disagreement over which one. - House: 1900s “company towns” are having a comeback. Resorts like Vail,

where rents spiked 20% during the pandemic, are building housing for workers to

make living more affordable in WFH hotspots.

ALLRIGHT! … …ready for the main course? Let’s look at the US Real Estate Market and how it performed

last week:

The Post-Pandemic Market Continues to Surprise…

It’s exactly 2 years since the onset of the pandemic…(I know…don’t remind me)…

Interest rates are at the highest level since 2019 and buyer demand has not backed off, and the post-

pandemic real estate market continues to surprise us.

Let’s start this week…again… with Inventory…

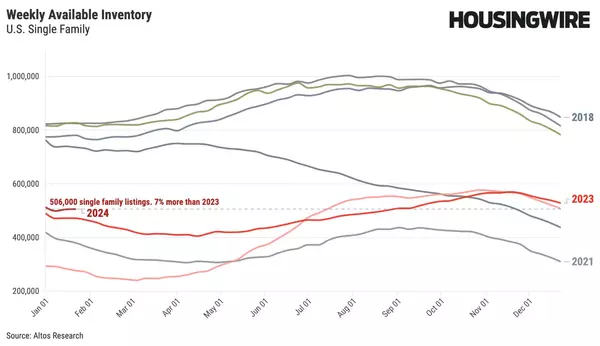

We ended the week with essentially the same amount of available, unsold inventory in the US

as last week with 247,608 homes in that category…the slight decrease was actually due to some

new home inventory being removed from the market due to extended completion dates.

To give some context to these numbers, in March of 2020, the lockdown had not hit yet and

there were 740,000 homes in this category of available, unsold single-family homes…almost 3

times the amount of inventory we have currently.

As interest rates rise, we do expect to see some rise in the inventory with a projected year-end

inventory of approximately 310,000 homes.

Pricing: The median home price has been inching closer to $400,000, a new record-high since

the first of the year. This week we ended up $1 shy of that threshold and came in at $399,999.

Demand…or immediate sales remains at 31% of the newly listed inventory. Out of the 81,000

homes that were listed last week, 25,319 homes went into contract within hours or days.

Historically, volume peaks at the end of June and with an expected rise of interest rates, and

sellers facing more competition from increased inventory, sellers could be better of …selling

now… rather than waiting to sell later in the year.

Days on Market…we are down to 28 days on market across the US…that’s ALL homes, all price

points. There are very few homes that have sat on the market for a very long time, including

those ‘wacky’ listings that tend to sit on the market forever…Last year in March, we had a 6-

week inventory of homes available for sale. This year…28 days, meaning, if there were no

homes listed for sale, we would run out of inventory in 28 days…

As we can see, the current trends continue to accelerate, week by week… and if history repeats

itself, inventory peaks in June, then this is what we expect to see for the remainder of the year.

Okay, friends… it’s time to get local…

Here is what happened in our local markets last week:

Castro Valley: This week the median list price for Castro Valley, CA is $1,499,000 with the

market action index hovering around 86. This is less than last month’s market action index of

- Inventory has increased to 24 and Median days on market (DOM) is at 7 and average days

on market is at 37. Market conditions have been consistently cooling in the past several weeks.

Because we’re still in the Seller’s zone, prices have not yet begun to drop. It may take a few

more weeks of slack demand for prices to reflect and begin to fall. Expect prices to fall if the

index persistently falls to the Buyer’s zone.

San Lorenzo: This week the median list price for San Lorenzo, CA is $793,000 with the market

action index hovering around 94. This is about the same as last month’s market action index of

- Inventory has increased to 6 and median days on market is at 0, however average days on

market is at 5. The market has been cooling over time and prices plateaued for a while. Despite

the consistent decrease in MAI, we’re in the Seller’s zone. Watch for changes in MAI. If the MAI

resumes its climb, prices will likely follow suit. If the MAI drops consistently or falls into the

Buyer’s zone, watch for downward pressure on prices.

San Leandro: This week the median list price for San Leandro, CA is $899,999 with the market

action index hovering around 90. This is less than last month’s market action index of 94.

Inventory has increased to 23 and median days on market is at 0 while average days on market

is at 6. The market has started cooling and prices have recently plateaued. Since we’re in the

Seller’s zone, watch for changes in MAI. If the MAI resumes its climb, prices will likely follow

suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure

on prices.

Hayward: This week the median list price for Hayward, CA is $950,000 with the market action

index hovering around 93. This is an increase over last month’s market action index of 88.

Inventory has decreased to 37. Median days on market is at 7 while average days on market is

at 37. Home sales continue to outstrip supply and the Market Action Index has been moving

higher for several weeks. This is a Seller’s market so watch for upward pricing pressure in the

near future if the trend continues.

Danville: This week the median list price for Danville, CA is $2,497,500 with the market action

index hovering around 85. This is an increase over last month’s market action index of 81.

Inventory has increased to 34. Median days on market is at 0 while average days on market is at

- While the Market Action Index shows some strengthening in the last few weeks, prices have

settled in a bit of a plateau. We are currently in a Seller’s market so prices will likely resume

their climb should this trend persist.

Is Now the time to Sell?

Crystal and I are asked this question often and our answer is always the same: DO NOT SELL

YOUR HOME…if you do not have a plan…a plan to downsize, upsize, invest, or move out of the

area…With the lack of supply and inflation, one of the worst things you could do is let your

money sit in the bank.

Crystal and I have a combined 54+ years of experience to put to work for you. Call us and put

our experience to work for you. Whether you are on the buy side or the sell side…feel

comfortable knowing that you are in skilled hands.

Ask us about some of our other services such as our Pre-Market Preparation program where

we’ll make those upgrades that have a high return on investment with no up-front costs to you

or how to purchase all cash, even if you haven’t sold your home yet.

We look forward to your questions about how to make your real estate dreams and goals

happen, and we will design a custom plan…just for you.

Have an outstanding week and …Happy Trails to You…until we meet again.

Warmly , Dean Souza

Dean & Crystal Souza

Realtor | Broker Associate

Century 21 RE Alliance – Souza Team

homes@souzateam.com

510-881-1761

DRE 00967442 | 01448392

Focused on the Success of Your Move

This is not intended to solicit properties or persons under contract.