‘Presidential/President’s Happy Monday with Dean & Crystal

Here are today’s irrelevant tidbits…

-What if I told you that the term ‘Bucket List’ didn’t exist until the release of the 2007 film, ‘The Bucket List’, starring Jack Nicholson and Morgan Freeman?

–Escapism: Disneyland just debuted a real-estate community called, ‘Storyliving’, for superfans, outside Palm springs…more to come on this.

Question: So… Dean…enough of your foolishness…How’s the Market?

Answer: Well…I’m glad you asked…

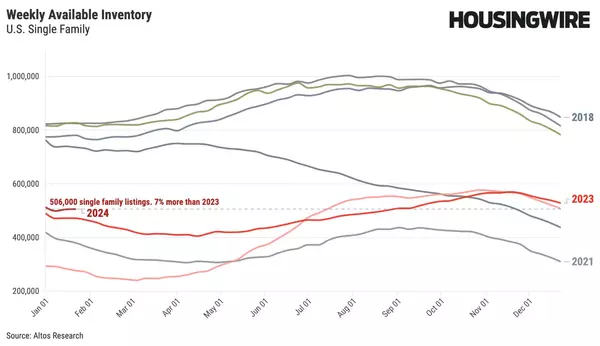

Well…mortgage rates keep spiking and there are so many Americans lining up to purchase homes that this has not deterred many buyers yet. Our record-low inventory fell again this week, but only by a few thousand homes…are these the tiny signals that change is in the wind?

For the week of February 21, 2022, the median home price in the US rose one-half of a percent to $382,000, up from $375,000 last Monday. Not to be alarmed because a week-to-week rise in prices for February is absolutely normal and historically, prices continue to rise like this week to week all the way until June.

Once again, this week the price of the new listings remained higher than the median price of the whole market. This tells us that sellers recognize that there is a surplus of buyers, they are pricing strong, and that future sales prices will continue to be elevated, at least through April/May. Today’s sales will become May’s news.

The available inventory of homes fell…again…to 248,000…which is less than 1% from last week’s then-record low. We are forecasting that the rising interest rates will show up in unsold inventory rather than price. We also expect that by Q4, we will end the year with more inventory than we ended 2021 with.

Are we turning a corner? It’s only one week…

Shall we get LOCAL? Here are the local market reports for our local market:

– Castro Valley: This week the median list price for Castro Valley, CA is $1,499,999 with the market action index hovering around 93. This is less than last month’s market action index of 94. Inventory has increased to 13 and the median days on market are at 7. In the last few weeks, the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone and prices have recently resumed upward pressure.

– San Lorenzo: This week the median list price for San Lorenzo, CA is $898,000 with the market action index hovering around 97. This is an increase over last month’s market action index of 96. Inventory has decreased to 4. The median days on market are at 0. In the last few weeks, the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

– San Leandro: This week the median list price for San Leandro, CA is $850,000 with the market action index hovering around 94. This is less than last month’s market action index of 95. Inventory has increased to 13. The median days on market are at 0. In the last few weeks, the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

– Hayward: This week the median list price for Hayward, CA is $899,000 with the market action index hovering around 88. This is an increase over last month’s market action index of 86. Inventory has increased to 41. The median days on market are at 0. While the Market Action Index shows some strengthening in the last few weeks, prices have not seemed to move from their plateau. Should the upward trend in sales relative to inventory continue, expect prices to resume an upward climb in tandem with the MAI.

– Danville: This week the median list price for Danville, CA 94526 is $2,250,000 with the market action index hovering around 83. This is about the same as last month’s market action index of 83. Inventory has increased to 11. In the last few weeks, the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

While the market appears to make things seem bleak if you are a buyer…and I can be…if you don’t have a proven strategy to present you and your family as the buyer’s that a seller wants to work with. It is truly a Team Effort, with you, the lender of choice and your Agent Team. When these elements are in alignment with a strategy, then you can and will be successful.

Crystal & I understand that and have the ability to make the right phone calls, ask great and engaging questions and create a working relationship with the seller’s agent before an offer is even written.

Reach out to us and let us in on your plans. There’s never any pressure to move on any agenda other than your own…and the best part about it is it’s…free.